Bernstein pegs Reliance as India’s eventual e-commerce kingpin

The Indian conglomerate Reliance is poised to outpace Amazon and Walmart-backed Flipkart in the race for the country’s $150 billion e-commerce market, analysts at Bernstein projected in a scathing report to clients this week, challenging the prevailing industry views that favor the incumbent global powerhouses.

Bernstein’s projection hinges on a quartet of compelling advantages that they argue will propel Reliance to the top: a robust retail network, a sweeping mobile network, a holistic digital ecosystem, and a “home field advantage” in a notoriously challenging regulatory landscape. These factors should help Reliance seize the majority of the massive e-commerce market in the longer run, the wealth management firm said.

Reliance Retail, a Reliance Industries subsidiary, is already a dominant force, operating the country’s largest retail chain, with over 18,000 stores. Bernstein sees the conglomerate’s expansive physical presence, bolstered by numerous recent acquisitions of retail companies with a focus on e-commerce, and a partnership with Meta to develop a small business communication platform through WhatsApp Business as constituting a formidable “competitive moat” for the Indian powerhouse. E-commerce still accounts for less than 10% of India’s overall retail.

Reliance Retail ecosystem. (Image and analysis: Bernstein)

In contrast, Flipkart, which is heavily reliant on the wireless and mobile category – accounting for half of e-commerce sales in India – is facing concerns as the country’s smartphone shipments slow. Moreover, the lower-margin nature of the smartphone category necessitates both Flipkart and Amazon to grow their high-margin categories.

For Amazon, the recent pledged $12.7 billion investment in Amazon Web Services in India suggests a shift in focus towards cloud services in the South Asian market. Bernstein’s report reveals that while Amazon’s cloud business operates with losses of merely $500,000 to $1 million, the e-commerce division has lost up to $500 million in India.

Furthermore, Amazon is losing ground in high-profit categories such as fashion. While Flipkart claims a commanding 60% market share in this sector, Amazon only captures 20%. Reliance’s AJio is hot on their heels, already securing over 15% of the fashion market, according to Bernstein.

Bernstein values Reliance Retail’s e-commerce business at $36.4 billion, surpassing Flipkart’s adjusted $33 billion valuation after the spin-off of PhonePe. The wealth management firm values Reliance Retail at $110.9 billion.

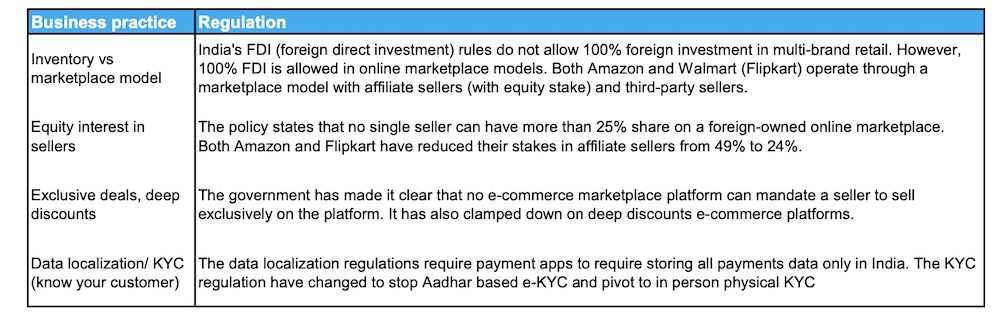

Arguably the most daunting obstacle facing Amazon and Flipkart is India’s complex regulatory environment. Local legislation prevents these marketplace-model firms from owning, selling, and pricing goods directly. In contrast, Reliance’s inventory-led model allows it to navigate these challenges with inventory control, pricing autonomy, and an enhanced customer experience.

E-commerce business practices and regulations in India (Image and analysis: Bernstein)

Bernstein also contends that India’s relatively undeveloped seller ecosystem hampers the execution of a pure marketplace model, a model that is responsible for over 80% of e-commerce gross merchandise value in China. Despite this, they note, the third-party model proves victorious in terms of SKU depth and is more straightforward in China due to the typical responsibility of merchants for fulfillment via express delivery companies.